Table of contents

- Introduction

- 🏁 1. What Is Waymo?

- 🔍 2. Waymo’s Core Businesses

- 💰 3. Is Waymo Publicly Traded? Can You Buy Waymo Stock?

- 📈 4. Waymo’s Valuation and Financial Background

- ⚙️ 5. Waymo’s Technology – How It Works

- 🚖 6. Waymo vs. Tesla – The Race for Autonomous Dominance

- 📊 7. Waymo’s Business Challenges

- 🚀 8. Will There Be a Waymo IPO? (Future Outlook)

- 💹 9. How to Invest in Waymo stock Future

- 🌐 10. The Future of Waymo stock and Autonomous Driving

- ❓ FAQs About Waymo Stock

- 💡 Conclusion

Introduction

The race to dominate autonomous driving technology has intensified, with companies like Tesla, Rivian, Cruise, and Waymo at the forefront. Among them, Waymo — Alphabet’s (Google’s parent company) self-driving car division — stands out as one of the most advanced and trusted.

With growing public attention toward AI and robotics, many investors are asking:

“Can I buy Waymo stock?”

The answer is not straightforward Waymo itself isn’t publicly traded, but investors can still gain exposure to it indirectly through Alphabet (NASDAQ: GOOGL).

This article explores Waymo’s history, valuation, financial background, technology, competitors, IPO potential, and how investors can prepare.

🏁 1. What Is Waymo?

Waymo is an autonomous vehicle company founded in 2009 as part of Google’s secretive “X” research lab, known at the time as the Google Self-Driving Car Project.

In 2016, it was officially branded Waymo — short for “A New Way Forward in Mobility.”

Key Facts about Waymo:

- Parent Company: Alphabet Inc. (NASDAQ: GOOGL)

- Headquarters: Mountain View, California

- Founded: 2009

- CEO (2025): Tekedra Mawakana

- Industry: Autonomous Driving / AI / Robotics / Transportation

- Competitors: Tesla, Cruise (GM), Aurora Innovation, Zoox (Amazon)

Waymo’s core mission is to make driving safer, cleaner, and more accessible through automation and artificial intelligence.

🔍 2. Waymo’s Core Businesses

Waymo is not just building technology — it’s creating real-world services and partnerships.

A. Waymo One – Self-Driving Taxi Service

- A ride-hailing service currently operating in Phoenix, Los Angeles, and San Francisco.

- Users can order fully autonomous rides through the Waymo app (similar to Uber or Lyft).

- Expansion plans include Austin, Miami, and other cities.

B. Waymo Via – Autonomous Trucking

- Focused on long-haul freight and delivery automation.

- Competes with Aurora, TuSimple, and Kodiak Robotics.

- Currently testing with partners such as UPS and JB Hunt.

C. Waymo Driver – Licensing and Partnerships

- Waymo licenses its technology to carmakers such as Jaguar, Chrysler, and Volvo.

- The “Waymo Driver” system can be integrated into different vehicle models.

💰 3. Is Waymo Publicly Traded? Can You Buy Waymo Stock?

No — Waymo is not currently a publicly traded company.

It is a subsidiary of Alphabet Inc., the parent company of Google.

However, investors can gain exposure to Waymo by buying shares of Alphabet (NASDAQ: GOOGL or GOOG). Alphabet owns 100% of Waymo, meaning that Waymo’s profits, expenses, and valuation indirectly influence Alphabet’s financials.

How to Invest in Waymo (Indirectly):

- Open a brokerage account (Fidelity, Charles Schwab, Robinhood, etc.)

- Search for Alphabet stock (GOOGL or GOOG)

- Buy shares to gain indirect ownership of Waymo

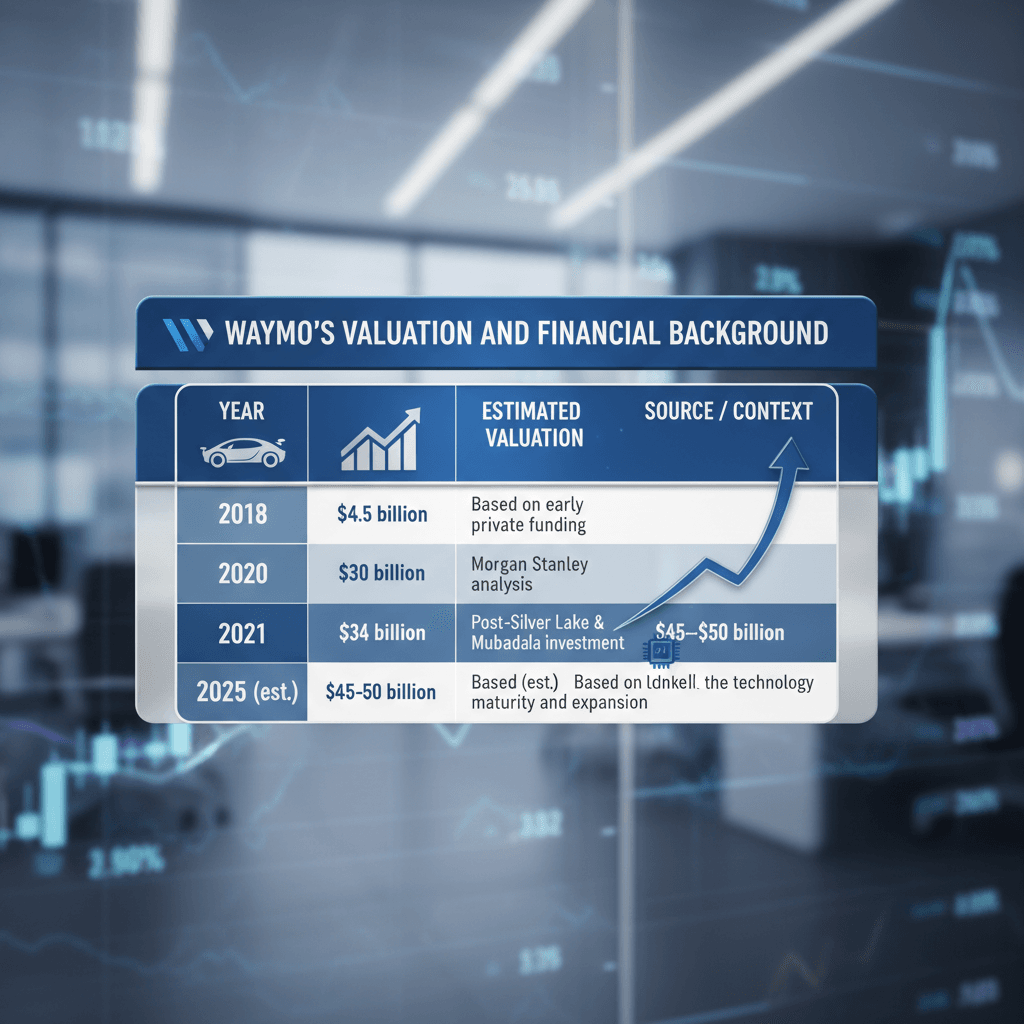

📈 4. Waymo’s Valuation and Financial Background

While Waymo does not release detailed financial statements, estimates from private market analysts provide insight.

Estimated Waymo Valuation Timeline:

| Year | Estimated Valuation | Source/Context |

| 2018 | $4.5 billion | Based on early private funding |

| 2020 | $30 billion | Morgan Stanley analysis |

| 2021 | $34 billion | Post-Silver Lake & Mubadala investment |

| 2025 (est.) | $45–$50 billion | Based on technology maturity and expansion |

Waymo raised over $3 billion from outside investors, including:

- Silver Lake Partners

- Mubadala Investment Company

- Andreessen Horowitz

- AutoNation

- Penske Automotive Group

This makes Waymo one of the most valuable autonomous vehicle startups in the world.

⚙️ 5. Waymo’s Technology – How It Works

Waymo stock uses a combination of advanced hardware and AI software to navigate without human input.

Core Components:

- LiDAR (Light Detection and Ranging): Measures distances with lasers to create 3D maps.

- Cameras: Detect road markings, signs, and obstacles.

- Radar: Tracks movement of other vehicles in all weather conditions.

- AI Neural Networks: Interpret data in real time to make driving decisions.

- High-Definition Maps: Provide centimeter-level accuracy.

- Redundant Systems: Backup braking, steering, and sensors for safety.

Safety Milestones:

- Over 30 million autonomous miles driven on public roads.

- Billions of simulated driving miles.

- Fewer accidents per mile than human drivers (based on internal studies).

🚖 6. Waymo vs. Tesla – The Race for Autonomous Dominance

| Feature | Waymo | Tesla |

| Ownership | Alphabet (Google) | Independent |

| Level of Autonomy | Level 4 (fully driverless in select areas) | Level 2+ (driver-assisted) |

| Main Focus | Robotaxi, freight | Consumer vehicles |

| Hardware | LiDAR, radar, cameras | Cameras only |

| Software | Proprietary AI + HD maps | Neural Net + Vision AI |

| Public Availability | Limited cities | Global consumer cars |

| Safety Record | Millions of driverless miles | Human-assisted only |

Summary:

- Tesla focuses on mass-market vehicles.

- Waymo focuses on driverless services and licensing.

- Both are leaders, but Waymo’s technology is closer to full autonomy.

📊 7. Waymo’s Business Challenges

Despite its innovation, Waymo faces several challenges:

A. High Costs

- R&D and LiDAR hardware are expensive.

- Scaling robotaxi networks takes billions in infrastructure.

B. Regulation

- Self-driving laws differ across states and countries.

- Safety approvals slow deployment.

C. Public Perception

- Accidents involving other autonomous vehicles have made some riders cautious.

D. Competition

- Cruise (GM) and Zoox (Amazon) are expanding rapidly.

- Tesla dominates media attention.

E. Profitability

- Waymo is not yet profitable; it remains an R&D-heavy business.

🚀 8. Will There Be a Waymo IPO? (Future Outlook)

Waymo has not announced any IPO date as of 2025.

However, analysts believe a Waymo IPO could occur within 2–3 years if:

- The robotaxi business scales profitably

- Regulatory frameworks stabilize

- Investor demand for AI and robotics stocks stays strong

A public listing could value Waymo between $40 billion and $60 billion, making it one of the largest IPOs in the mobility industry.

Until then, Alphabet stock remains the only way for investors to participate in Waymo’s growth.

💹 9. How to Invest in Waymo stock Future

Option 1 – Buy Alphabet (GOOGL) Stock

- Direct exposure to Waymo, Google Cloud, YouTube, and AI investments.

- Ticker: GOOGL or GOOG (Class A and C).

Option 2 – Invest in Autonomous Vehicle ETFs

These funds include companies involved in self-driving technology:

- ARK Autonomous Technology & Robotics ETF (ARKQ)

- Global X Autonomous & Electric Vehicles ETF (DRIV)

- iShares Self-Driving EV and Tech ETF (IDRV)

Option 3 – Wait for Waymo IPO

Track announcements through Alphabet’s investor relations or the SEC.

🌐 10. The Future of Waymo stock and Autonomous Driving

Waymo’s future looks promising due to the growing AI revolution in transportation.

Key Drivers of Future Growth:

- Increased urban adoption of robotaxis.

- AI improvements in perception and safety.

- Expansion into freight logistics through Waymo Via.

- Licensing deals with automakers.

- Reduced sensor costs, improving profitability.

Industry experts predict that autonomous vehicles could make up 10–15% of all traffic by 2035, with Waymo playing a central role.

❓ FAQs About Waymo Stock

No. Waymo is privately held under Alphabet Inc. You can only invest in Waymo indirectly by purchasing GOOGL or GOOG shares.

Waymo does not have its own ticker symbol. It is part of Alphabet (GOOGL).

As of 2025, Waymo’s estimated valuation is between $45 billion and $50 billion.

There is no official IPO date, but analysts expect a public offering once Waymo becomes consistently profitable.

Not yet. It’s still in its investment and expansion stage.

You can invest in:

Alphabet (GOOGL)

Tesla (TSLA)

General Motors (GM)

ETFs focusing on AI and self-driving vehicles.

Waymo’s cars are completely driverless, while Tesla’s are driver-assisted.

Waymo emphasizes robotaxi services, not consumer vehicle sales.

Yes. It partners with Jaguar, Chrysler, Volvo, and Renault-Nissan.

Fully autonomous service is active in Phoenix, San Francisco, and Los Angeles, with plans for Austin and Miami.

Yes — Alphabet provides diversified exposure to Waymo, AI, cloud, and YouTube.

💡 Conclusion

Waymo stands at the forefront of the autonomous driving revolution. Its cutting-edge technology, decades of data, and strong backing from Alphabet make it a potentially transformative company in transportation.

While Waymo is not yet publicly listed, investing in Alphabet (GOOGL) remains the best way to gain exposure.

As the company moves toward profitability, an eventual Waymo IPO could become one of the most anticipated tech listings of the decade.

For now, Waymo remains a hidden gem within Alphabet’s portfolio — a bet on the future of AI-driven mobility and safer, smarter transportation.

More Blog : newstechhack.com